By Dr Hanudin Amin

RIBA refers to an increase and excess, arose from the money to money transactions without requiring defined commodities. In banking practices, however, riba occurs if these are found. First, there is a surplus over the loan capital. Second, the determination of this surplus is tied up with time. Third, the stipulation of this surplus is found in the loan contract.

Unlike riba, ribh also refers to an increase and excess, which occurs due to the proliferated of trading that is associated with effort (kasb), risk (ghurmi) and liability (dhaman). The two footings should not be viewed identical though they share increased implication in a financial transaction.

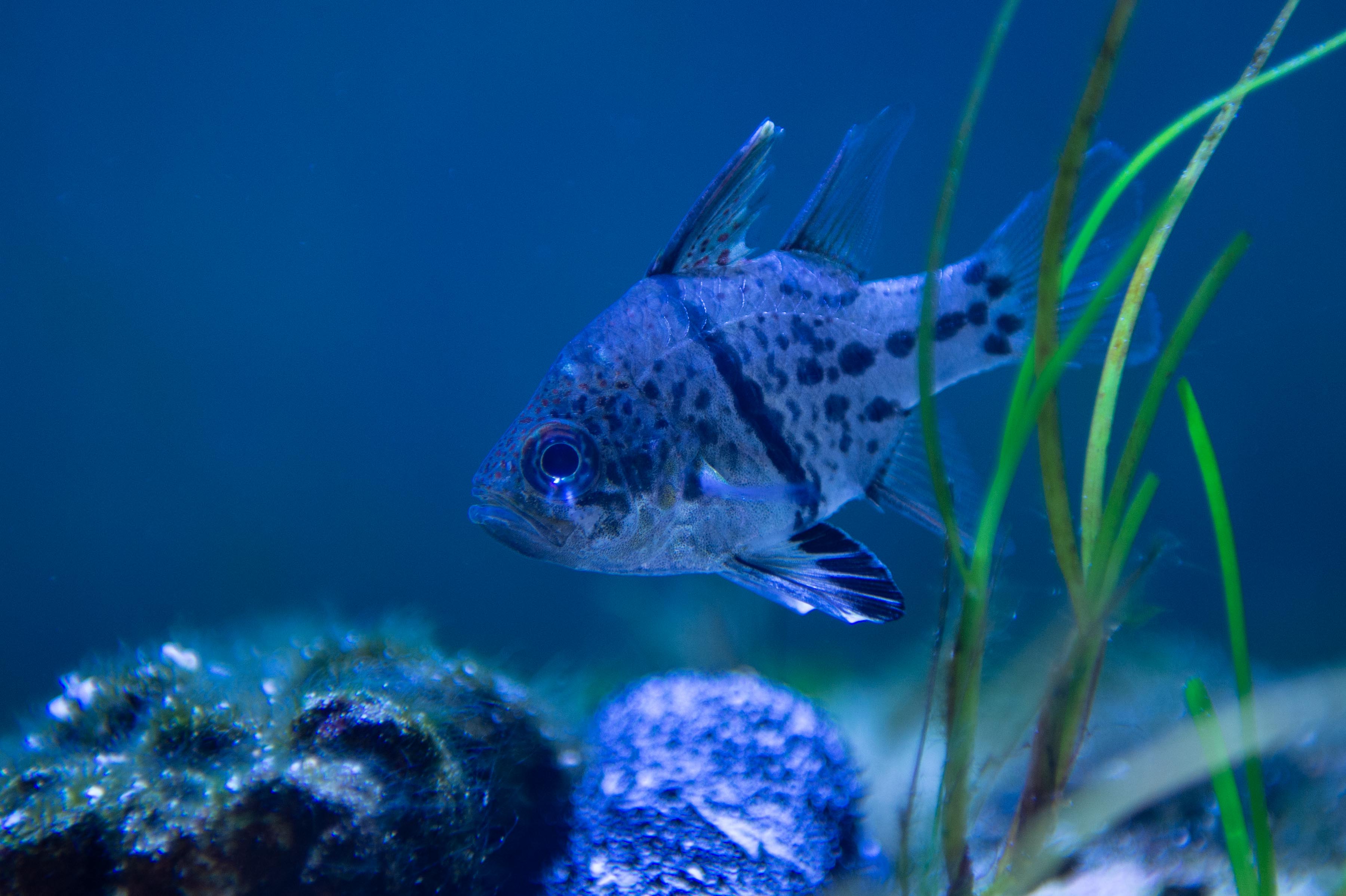

The primary source drawn from the Quranic verse taken from Surah al-Baqarah (2: 275) provides a clear demarcation between a sale (al ‘bay) and riba. For instance, Ali asks a loan of MYR10,000 from Bank X that imposes a 10 per cent interest rate, resulting in the repayment amount of MYR11,000. This is riba. Whilst Abby obtains a fish supply from Akky a fisherman at MYR10,000 and later Abby sells the fish to Abu at MYR11,000. This is ribh.

Explaining in more detail, the former holds money to money transactions whilst the latter acknowledges money to commodity transactions or vice versa. In more detail, the former is equally tantamount to riba due to the unjustified addition imposed on the loan extended. The latter is a trade due to the justified effort, risk and liability.

There exists a paradox that suggests both ribh and riba are alike although they are different from one to another. Laymen justify this view from the heightened implications shared by both of them, implying the two have similar footings that bread new money out of forced injustice to reveal its merit at the expense of faithfulness. It is, however, a fallacy.

In this line of thought, two questions are answered. Q#1 – What are the variances between ribh and riba? Q#2 – Are there any issues sprung from these footings in contemporary Islamic banking practices?

To improve our understanding pertinent to the discrepancies between ribh and riba, these differentiators are offered.

DIFFERENTIATOR #1: Trade and investment activities typically generate profit for mutual considered impacts to buyers who earn the usufruct of the bought commodities whilst sellers earn the profit drawn from the selling of the commodities to the former. When the generated profit is expected, the equivalent counter–value is a source of explanation of why the current practice of Islamic banking is nothing but a sale. Unlike Islamic banks, the elements of effort, risk and liability are missing dimensions in their peers. The principle of lending and borrowing is a contributing factor.

DIFFERENTIATOR #2: The transacting parties in trade are greater than two personnel or more than three depending on the nature of transactions. In the case of tawarruq, for instance, there are at least four transacting parties involved in covering the buyer (the customer), the seller (the customer), the buying and the selling brokers. Riba transaction, however, involves only two transacting parties – be it the bank or the customer. In the case of personal loan, the bank becomes a creditor – the one who lends out money. The customer, on the other hand, becomes a debtor – the one who borrows money.

DIFFERENTIATOR #3: Profit is the increase resulting from the change of money from a state to another as money becomes commodities and then the commodities are converted into money again. Profit is sourced from the creation of a noteworthy economic advantage that requires an increase in the initial capital, which is sourced from the said equivalent counter–value. Whilst riba is an increase in the money itself without any change and no added value is instituted.

DIFFERENTIATOR #4: Profit allows an augmented justice and brotherhood (JB) among the transacting parties when trading is conducted according to Shariah principles, upholding the fairness in every layer of business processes, from the price asking until the conclusion of the buying behaviour. Instead, riba formulates an egocentric culture, where every loan activity is not aimed at helping poor and needy but instead is aimed at increasing one’s wealth.

Ribh and riba are entirely two different footholds. Some issues, however, are drawn from the gaps explained due to the scant understanding of the context of riba emerged among individuals in our society sourced from the earning of marginal comprehensions of the concerning thought. Riba is a broad concept and applies when a condition is decided at the beginning of the contract. For instance, Ali creates riba as he imposes a condition of filing a fuel tank to Abu for a car lending. This knowledge is somewhat falling short out of unknown wisdom drawn from restricted generalisation.

Yet, the profit-taking has no profit ceiling (PC) whereby the seller can impose 100 per cent of the profit rate. In reality, however, there is abuse in that a seller exercises such an extension that allows price discrimination for different folks and natural monopolies. Thus, the gap that existed between ribh and riba is reduced, claiming that both are alike is true out of the shared increased implication. To address, the taking of profit moderately is the key to breed mutual wellbeing.

Ribh is asked to differentiate itself from riba through JB. Seller and buyer can promote welfare-based trading. Two perspectives are shared here. When a seller is a poor guy, the buyer is expected to give extra as sadaqah from him to the former beyond the cost price offered. When a seller is a rich folk, the buyer is expected to ask a discount as sadaqah from the former to him at reduced cost price offered.

In all, ribh and riba are two different lexicons in which the former helps improve the mutual benefit to all layers of individuals through the formation of the increased business ecosystem that helps improve the general society at large. The latter, however, mars the quality of individuals’ brotherhood as rich becomes richest and poor becomes poorest due to the asymmetry imagined wealth distribution. A recurring teething issue leads the way.

A continued educational programme which is inventive and sharp is useful to jack up people literacy on the optimism of ribh and the pessimism of riba. Led by proper action, the demand for Islamic banking products is sharpened accordingly owing to a positive conception of ribh at the expense of the riba. Of course, everyone is expected joining hands to uphold ribh for the gained public image of Islamic banking operations, where the practice of “acceptable profits” and “unacceptable profits” is learnt accordingly, at least.

*The author is an Associate Professor at the Labuan Faculty of International Finance, Universiti Malaysia Sabah, Labuan International Campus. He has a PhD from the International Islamic University Malaysia (IIUM) in Islamic Banking and Finance (PG310163). He can be contacted at This email address is being protected from spambots. You need JavaScript enabled to view it.